The instability of Circle’s USDC has caused extreme fear in the market, as stablecoins play a crucial role in the cryptocurrency industry. Bitcoin’s price was affected by the recent turmoil and has declined, but it faces a strong support level.

Technical Analysis

By Shayan

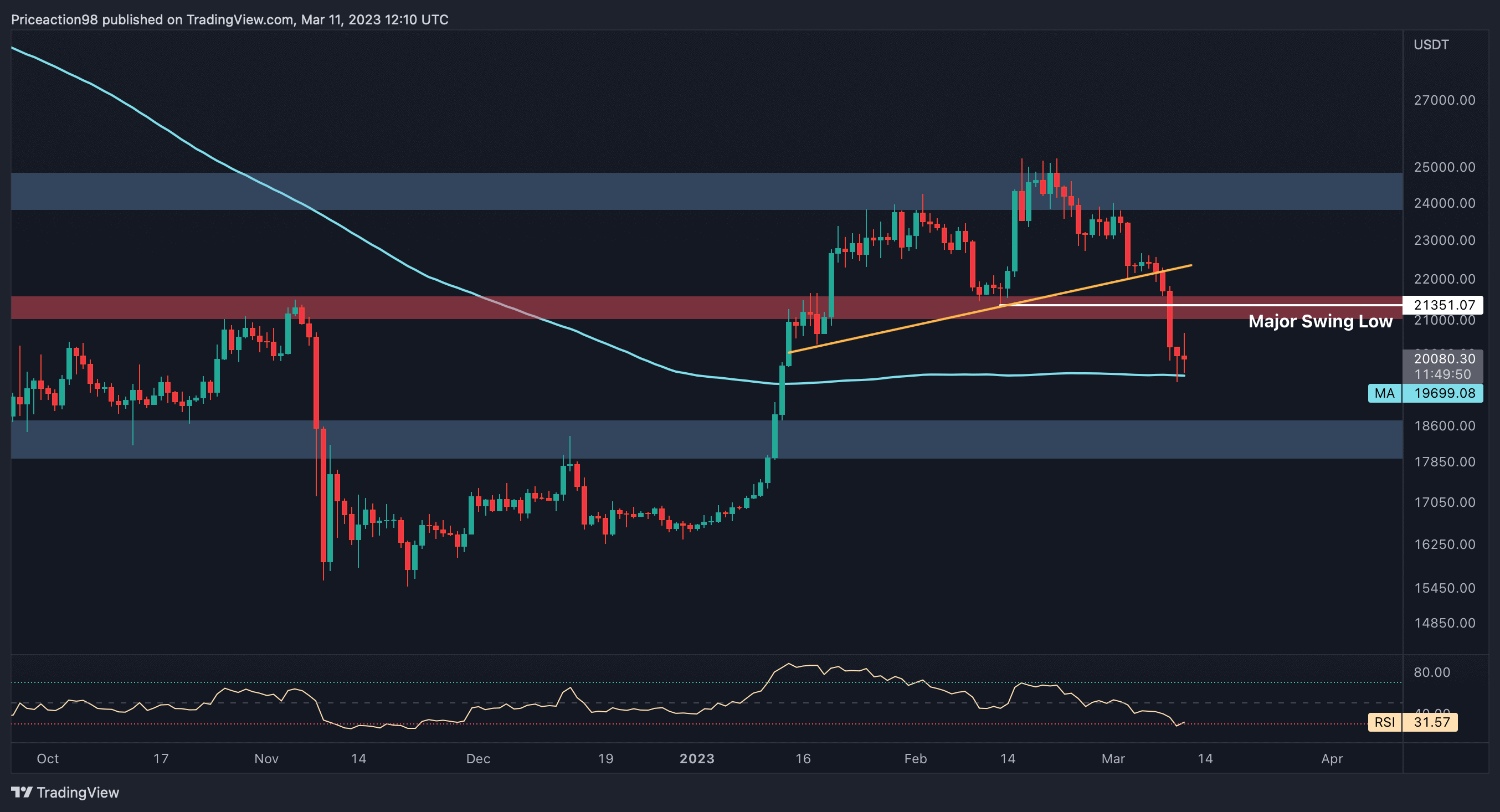

The Daily Chart

Recently, the price of Bitcoin experienced a downtrend with noticeable bearish momentum after forming a reversal three-drives pattern and breaking down the neckline. The recent turmoil with USDC served as a catalyst for the bearish trend and pushed the price down toward the $19K level.

However, the price faces significant support at the 200-day moving average, approximately at $19.6K, and is attempting to surpass it. This moving average is a powerful support level, and the bears might find it difficult to push the price below it.

Despite this, the daily timeframe suggests that bearish momentum has weakened, and a short-term consolidation stage may occur before the next impulsive move.

Source: TradingView

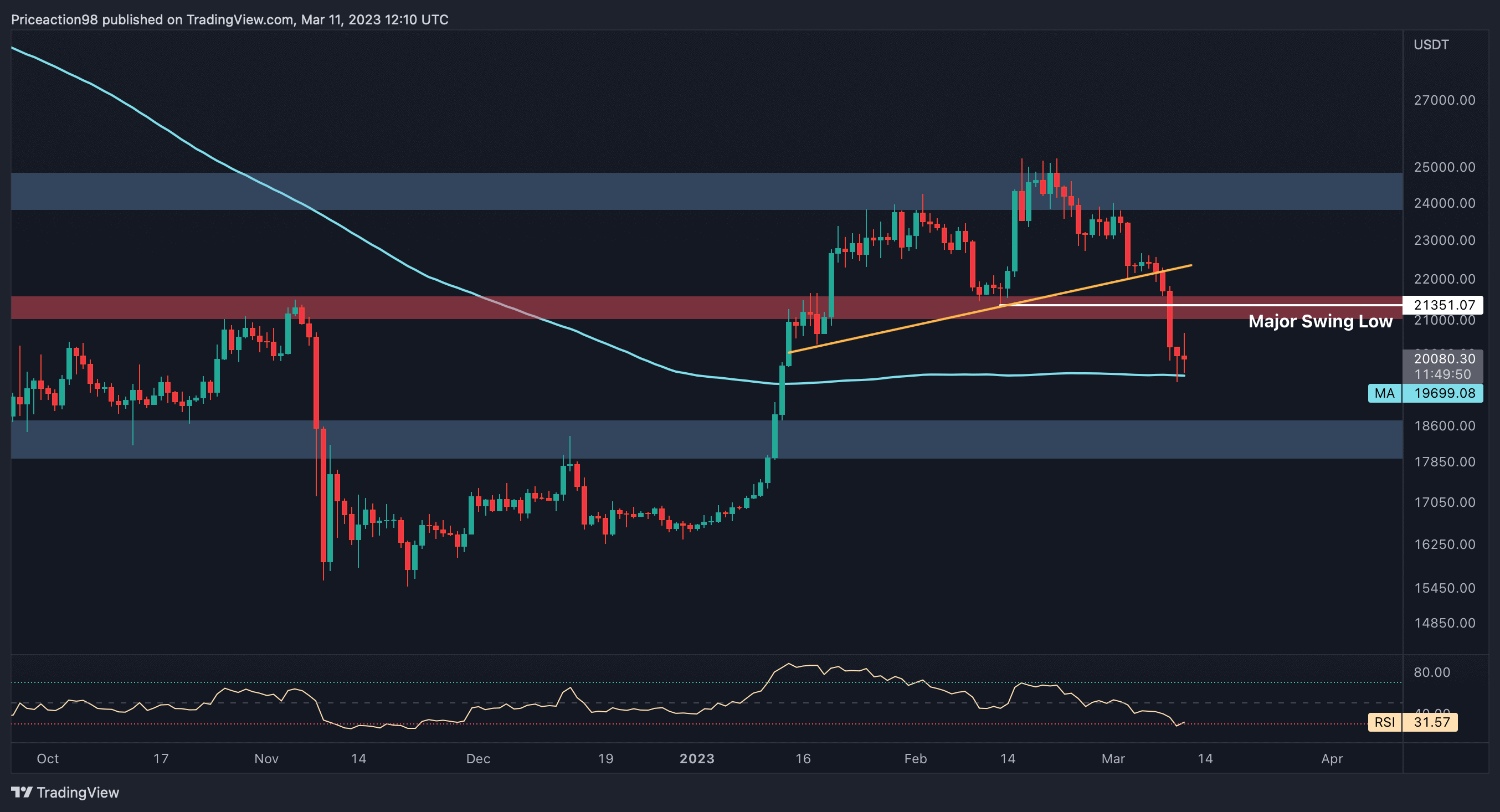

The 4-Hour Chart

The price of Bitcoin has experienced a massive decline after breaking the critical support level of $22K, resulting in consecutive big red candles. However, every impulsive trend requires a cool-down phase, along with a correction.

Bitcoin appears to have entered the mid-trend correction stage after reaching a decisive price level at $20K. This level also serves as sentimental support. Additionally, the 61.8 level of the Fibonacci retracement for the recent bullish trend aligns with the $20K level of support, making it a substantial level.

Source: TradingView

Therefore, the price may consolidate in the current region, forming a correction pattern before trending lower.

On-chain Analysis

By Shayan

The cryptocurrency market has once again entered a stage of fear and uncertainty due to the recent turmoil with Circle and the failure of SVB bank. As a result, market participants have capitulated and rapidly sold their assets to manage their risks.

The Funding Rates metric provides insight into traders’ sentiment and has recently declined impulsively, coinciding with a shakeout in Bitcoin’s price. Traders must be careful and monitor the perpetual market closely in case of another sudden price move.

Source: TradingView

Despite this, the market may become highly volatile with no specific direction in the upcoming days.

The post BTC Loses 15% Weekly, Will $20K Hold or is Another Crash Imminent? (Bitcoin Price Analysis) appeared first on CryptoPotato.