The resurgence of institutional interest in Bitcoin this month has investors and analysts pondering just how high its price could go within the next two years – especially with the ‘halving’ just around the corner.

Here’s what analysts have to say regarding Bitcoin’s price cycles and what kind of money it would take to send it to the moon.

Institutional Involvement

Throughout June, a number of high net-worth asset managers, including BlackRock and Fidelity, filed applications to launch a Bitcoin spot ETF in the United States.

Major banks and investment managers, including BNY Melon, Invesco, Morgan Stanley, and others, have already dabbled in launching Bitcoin-related products, such as OTC trading or custody services.

When taking a look at some of the largest financial companies involved in the space already, their total assets under management come out to at least $27 trillion, according to Meltem Demirors – Chief Strategy Officer of CoinShares.

1/ last week’s @BlackRock spot Bitcoin ETF filing was big news!

but, it’s not the only story. many of the largest financial institutions in the US are actively working to provide access to Bitcoin and more.

a quick glance – $27 trillion of client assets here! pic.twitter.com/azmHZmUL2a

— Meltem Demirors (@Melt_Dem) June 26, 2023

Theoretically, Bitcoin’s price could multiply by several times if these firms enter the market with just a small fraction of their wealth – especially given the market’s current liquidity levels.

In an email to CryptoPotato, James Check – Lead On-chain analyst at Glassnode – explained that roughly 450,000 BTC (~$13.5 billion) are “highly active in spot markets and predominantly participate in price discovery.”

“It is extremely difficult to measure a dollar in == market move, but this at least allows us to provide a range / bound the problem,” he said.

In 2021, ARK Invest’s Cathie Wood – whose firm is also trying to launch a Bitcoin ETF – predicted that Bitcoin could reach $500,000 if institutional investors allocate 5% of their portfolios to the asset.

HODLer Behaviour

As Bitcoin’s price rises, it’s possible that prior investors choose to take profits by selling their assets, thus absorbing the bullish impact of any liquidity entering the market.

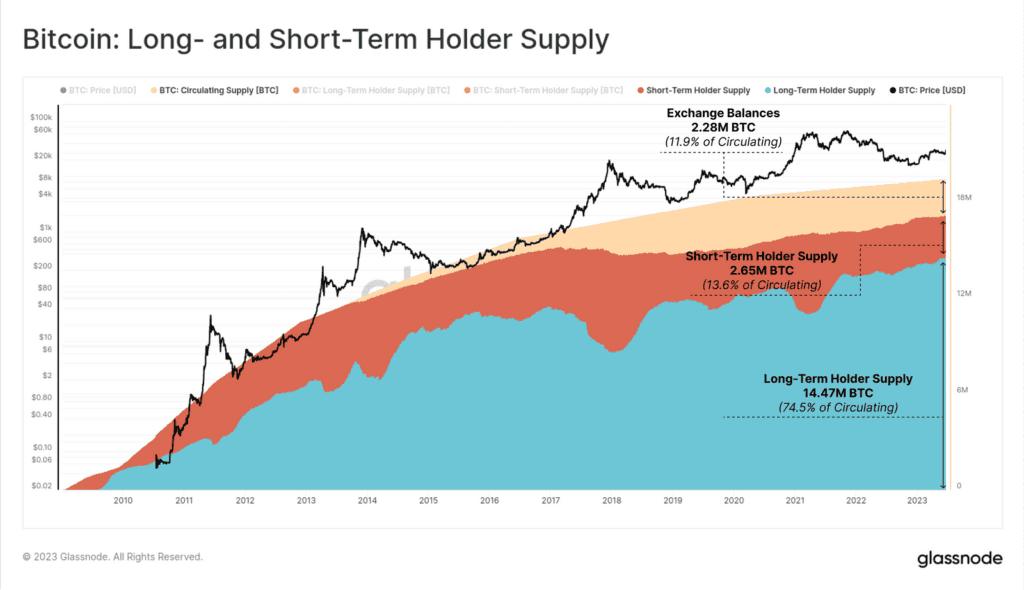

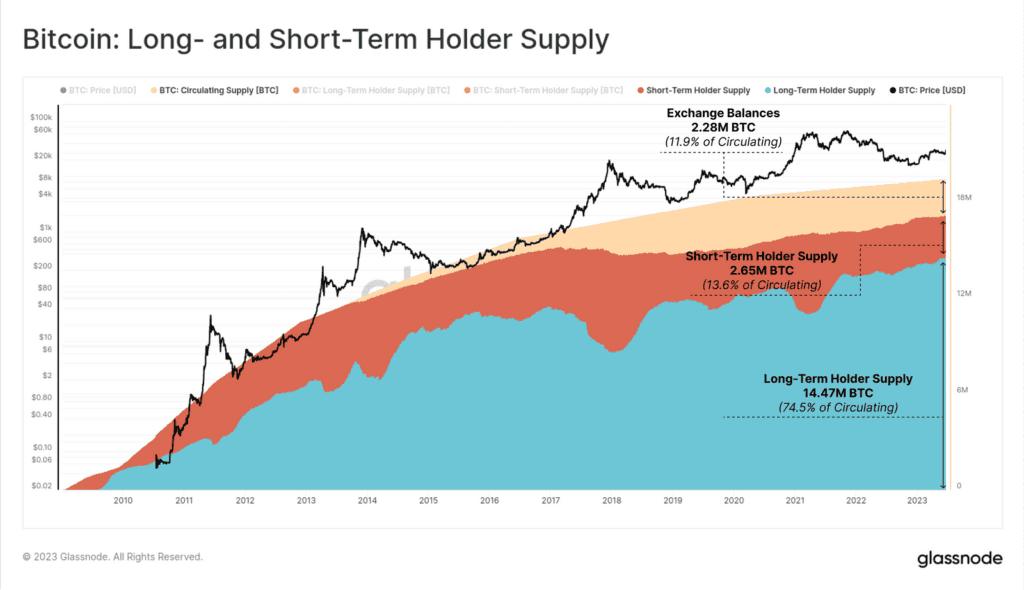

However, many market intelligence firms, including Santiment and Glassnode, have noted an “ongoing transfer of wealth from investors with high time preferences towards HODLers” in recent months. Meanwhile, Bitcoin on exchanges is also lower than ever.

Bitcoin Long and Short Term Holder Supply. Source: Glassnode

CryptoQuant data from this month appears to back this up, showing that long-term holders have largely reduced their selling activity over the past six months. “This change in LTH behavior may signal the beginning of a new bull cycle,” wrote analyst Axel Adler Jr in a post.

Investors have noted in the past that Bitcoiners have remarkable conviction, in general, to keep their holdings on hand – regardless of price. Paul Tudor Jones, for example, added that 86% of Bitcoin holders did not sell their assets when their price dropped from $17,000 to $3,000 between 2017 and 2018. Stanley Druckenmiller was also bullish on the asset last month due to its holders being “religious zealots.”

What About The Halving?

Ironically, some analysts don’t think the halving – the event of Bitcoin’s inflation rate falling by 50% every four years – may have a strong impact on the market after its arrival in April 2024.

Bitcoin’s historic bull runs in 2013, 2017, and 2021 have all followed one year after a halving. While the connection may seem self-evident, a report from Coinbase this month argues that each cycle may not have been so connected to the halving as much as other factors.

“Outside of the third halving, evidence that these halving events supported bitcoin price action is not entirely clear cut,” it states. 2013 and 2020 were coupled with central banks conducting major rounds of quantitative easing, while 2016 was when the Bank of England resumed its bond-buying program in response to Brexit.

CryptoQuant’s Head of Marketing backs this more skeptical view. “I also agree with the fact that the halving impact on the Bitcoin price is decreasing as the new supply limit decreases significantly,” he told CryptoPotato via DM.

However, Chung noted other factors are worth being bullish about – such as institutional involvement after BlackRock’s ETF filing. “You can see that the fund holding volume spiked after the BlackRock announcement,” he said.

Bitcoin Fund Holdings. Source: CryptoQuant

China’s growing involvement in crypto is also likely to increase liquidity and demand. Hong Kong is offering licenses to exchanges, such firms are giving banking access to the industry, and retail traders in the region are being allowed to trade major crypto assets.

The post How Much Money Does it Take to ‘Moon’ Bitcoin? Analysis appeared first on CryptoPotato.